Medicare tax calculator 2023

2021 Tax Calculator Exit. It will be updated with 2023 tax year data as soon the data is available from the IRS.

2023 San Francisco Hcso Expenditure Rates Released

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

. Medicare Wages W-2 box 5 use 0 if no W-2 Other Family Incomes. Ad Learn What Medicare Does And Does Not Cover And When To Start Coverage. Refer to Publication 15 Circular E Employers Tax Guide for more information.

Discover Helpful Information And Resources On Taxes From AARP. 20 of the Medicare-approved amount for durable medical equipment like wheelchairs walkers hospital beds and other equipment Hospice care. The standard Part B monthly premium in 2021 was 14850 and in 2022 the amount increased to 17010.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Heres what you need to know. This calculator is integrated with a W-4 Form Tax withholding feature.

Estimate in 2022 and e-File in 2023. Employers and employees split the tax. This is the amount youll see come out of your paycheck and its matched with an additional 145 contribution from your employer for a total of 29 contributed on your behalf.

Form 8960 Net Investment. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. What is a 202308k after tax.

Begin tax planning using the 2023 Return Calculator below. Form 8959 Additional Medicare Tax. Estimated Tax Paid.

2021 Tax Calculator Exit. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

You can use the Medicare levy calculator. Form 1040 Schedule 8812 Child Tax Credit. Offer period March 1 25 2018 at participating offices only.

Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction which lowers their. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return. The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers.

On the other hand if you make more than 200000 annually you will pay 09 additional Medicare tax for the balance exceeding 200000. You pay all costs. 19450 copayment each day.

2021 Medicare tax rate. This Tax Calculator Lets You Estimate Your Taxes. Following your calculation method if inflation is -2 the 2024 IRMAA will be 100000.

Understanding what propelled the 2022 premium increase can give you a sense of what to expect in 2023. For 2024 IRMAA your forecast is 101000 with zero inflation from now till August 2023. You need to consider your eligibility for a reduction or an exemption separately.

2023202 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified adjusted gross income exceeding a threshold based on your. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 118405904 net salary is 202308200 gross salary. What is a 20232k after tax.

Form 8960 Net Investment Income TaxIndividuals Estates and Trusts. 0 for covered home health care services. To qualify tax return must be paid for and filed during this period.

Calculate Your 2023 Tax Refund. Days 101 and beyond. So each party pays 765 of their income for a total FICA contribution of 153.

Click here to see why you still need to file to get your Tax Refund. 116504782 net salary is 202320200 gross salary. Free SARS Income Tax Calculator 2023 TaxTim SA.

To calculate your FICA tax burden you can multiply your gross pay by 765. Based on your forecast It is pretty sure that the 2023 IRMAA will be around 97000 or 98000 for individual or MFS. This calculator is for the 2022 tax year due April 17 2023.

2023082 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. You can use the Medicare levy calculator. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income.

You may get a reduction or exemption from paying the Medicare levy depending on your and your spouses circumstances. We also offer ones covering. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

Form 8959 Additional Medicare Tax. Tax Planning Consideration for IRMAA 2023. The Medicare Decision Guide Can Help You Find The Plan That Is Right For You.

Pundits are suggesting premiums will decrease for 2023. Return filed in 2023 2021 return filed in 2022 Income. The federal tax you are going to pay varies according to the information you provide on the Form W-4.

May not be combined with other offers. Check out our chart on the different parts of Medicare explained. Person 1 Husband Earned Income.

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. Social Security and Medicare Withholding Rates. Whats The Current Medicare Tax Rate.

In 2021 the Medicare tax rate is 145.

Why A Record Cola Increase In 2023 Could Backfire On Seniors

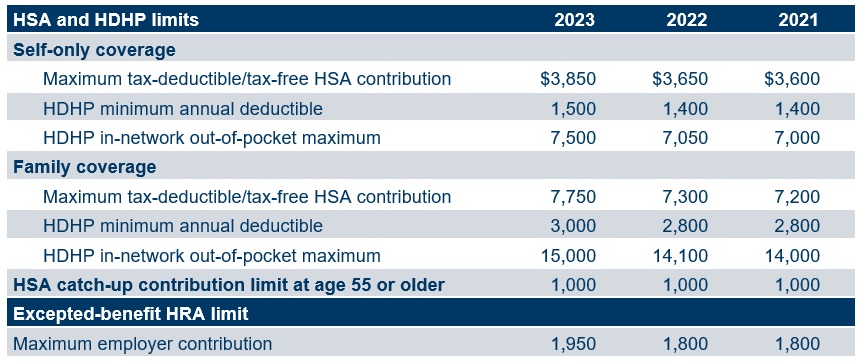

2023 Hsa Hdhp And Excepted Benefit Hra Figures Set Mercer

4 Social Security Changes To Expect In 2023 The Motley Fool

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

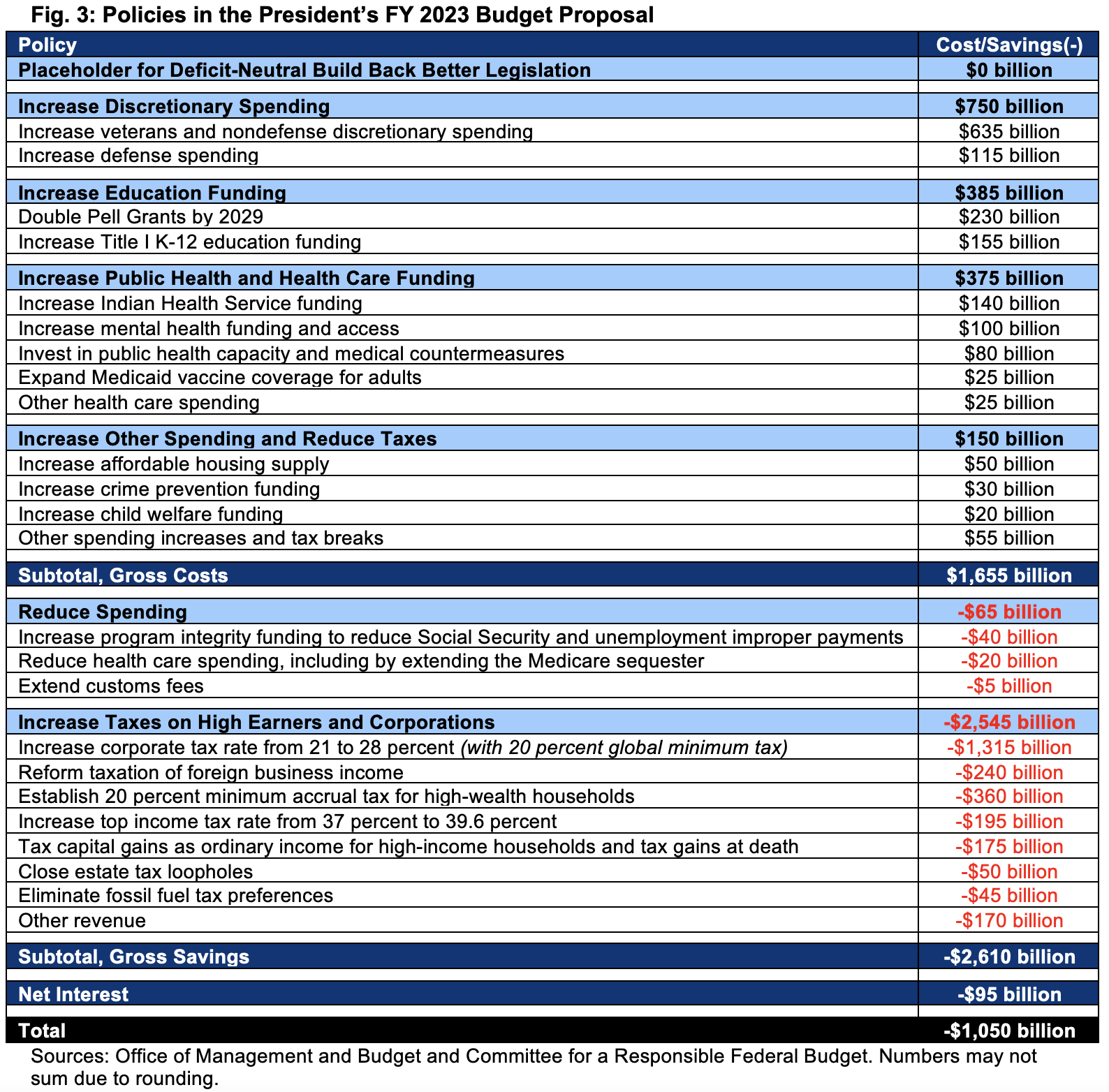

Biden S 5 79 Trillion 2023 Budget Proposal Would Also Expand Regulation

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

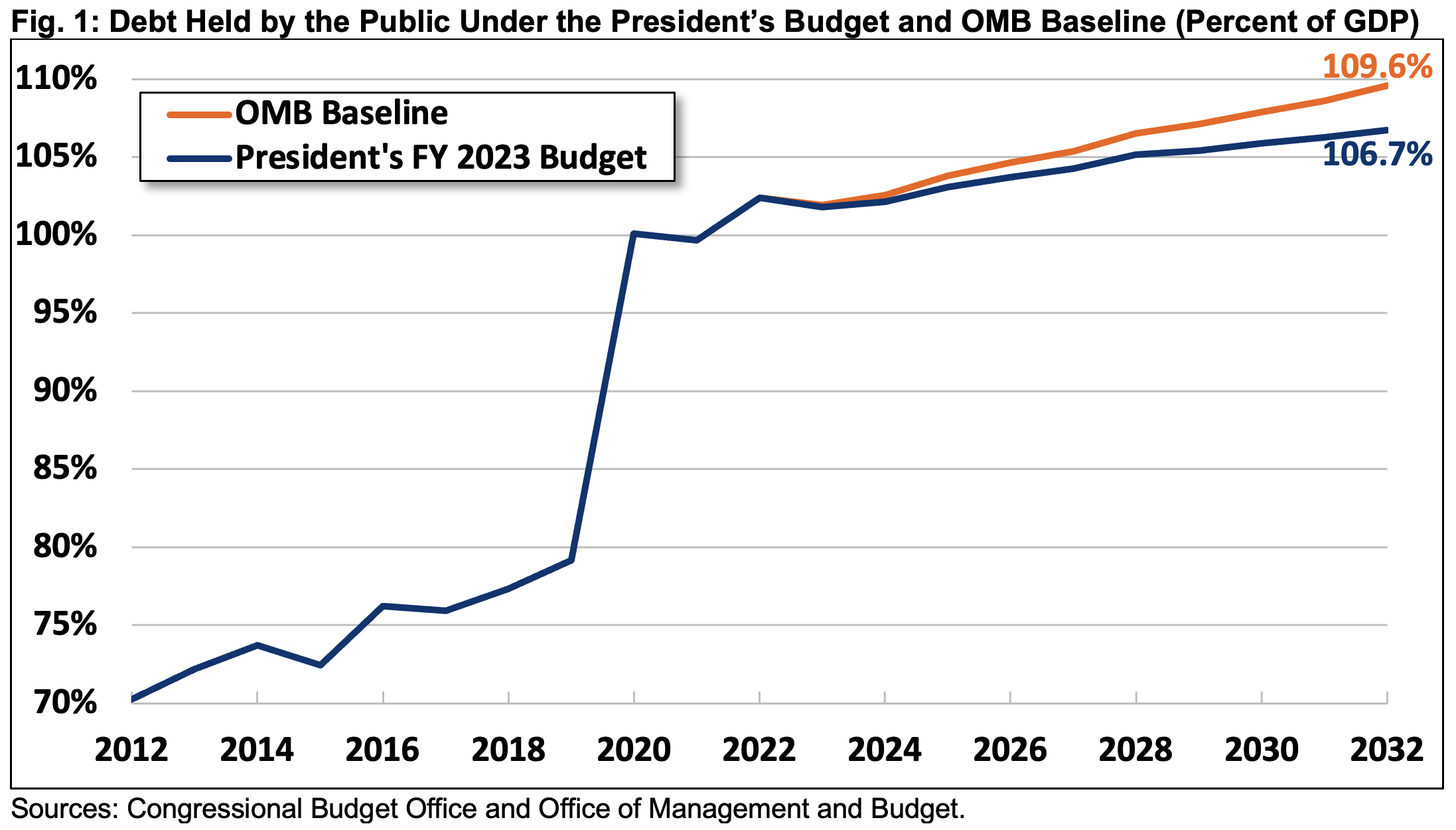

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

2023 Lexus Rx Adds Turbos Electrical Power

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

Could 2023 Social Security Cola Hit 9 Benefitspro

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Social Security Benefits 2023 When Will The Cola Increase Be Decided Marca

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Social Security What Is The Wage Base For 2023 Gobankingrates

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget